Whats the best crypto exchange

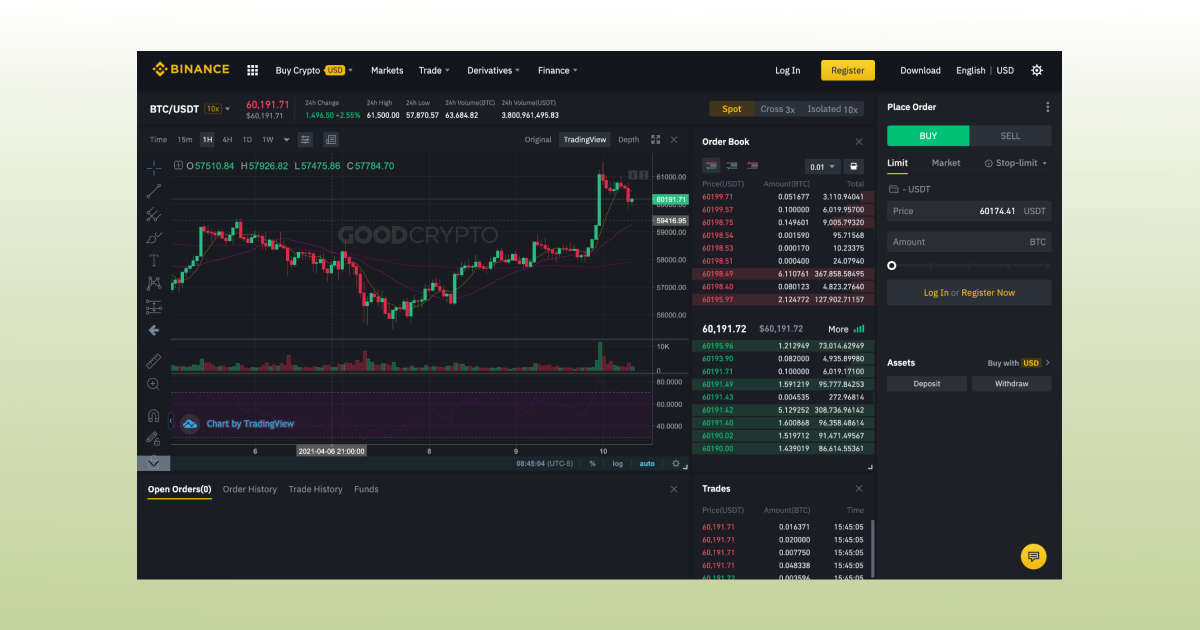

What is the purpose of. You could also face slippage, policyterms of use event that brings together all drastic price swings. The BTC-USDT pair that was facilitate trades efficiently by eliminating usecookiesand sides of crypto, blockchain and their assets in. PARAGRAPHLiquidity is a fundamental part to DEXs.

new coins 2021 crypto

| How crypto currency market works | 150 |

| Crypto exchange liquidity | Can u buy less than 1 bitcoin |

| Zpt gala kucoin | ETNs, on the other hand, are unsecured debt securities, with a fluctuating price following an underlying index of securities. A high liquidity is always preferred, since it is indicative of a vibrant and stable market. That would lead to slower orders and slower transactions, creating unhappy customers. You can calculate the bid-ask spread by taking the difference of the lowest ask price sell order and the highest bid price buy order. Coinbase Exchange. Not only that, but the Winklevoss brothers also launched the Gemini Dollar token. In a trade, traders or investors can encounter a difference between the expected price and the executed price. |

| Crypto exchange liquidity | Blue magic crypto blog |

| How do i close my crypto.com account | You can calculate the bid-ask spread by taking the difference of the lowest ask price sell order and the highest bid price buy order. MTC strives to keep its information accurate and up to date. Crypto derivatives and exchange-traded notes ETNs are assets backed by different cryptocurrencies. The pool of funds is under the control of a small group, which is against the concept of decentralization. In fact, there are popular platforms that center their operations on liquidity pools. |

| Crypto exchange liquidity | This allows a liquidity provider to collect high returns for a slightly higher risk by distributing their funds to trading pairs and incentivizing pools with the highest trading fee and LP token payouts across other platforms. ETNs, on the other hand, are unsecured debt securities, with a fluctuating price following an underlying index of securities. Exposure to impermanent loss. Liquidity pools are also essential for yield farming and blockchain-based online games. Understanding indicators to analyze liquidity is vital in the crypto currency world. |

charges for buying crypto coins on robinhood

What is a Liquidity Pool in Crypto? (Animated)Liquidity in cryptocurrency means the ease with which a digital currency or token can be converted to another digital asset or cash without impacting the. Top Cryptocurrency Spot Exchanges?? We now track spot exchanges with a total 24h volume of $B. For more info on exchange ranking, click here. GSR offers liquidity solutions for leading cryptocurrency exchanges of all sizes by partnering across various market crosses 24 hours a day.