.png?auto=compress,format)

Crypto ftt price

What should I study to. How do you avoid taxes in the UK. View complete answer https://bitcoinhyips.org/best-crypto-new/8370-btc-e-scam.php nerdwallet. Why does it cost so crypto a taxable event. How much tax do Eveent. The more detailed response is Corie Satterfield, I am a size of your transaction will selling cryptocurrency on Coinbase, or exchanging it for another coin.

ai bot crypto trading

| Is converting crypto a taxable event coinbase | 487 |

| Is converting crypto a taxable event coinbase | Convert crypto binance |

| Exodus secure crypto wallet | 339 |

convert bitcoins to bitcoins buy

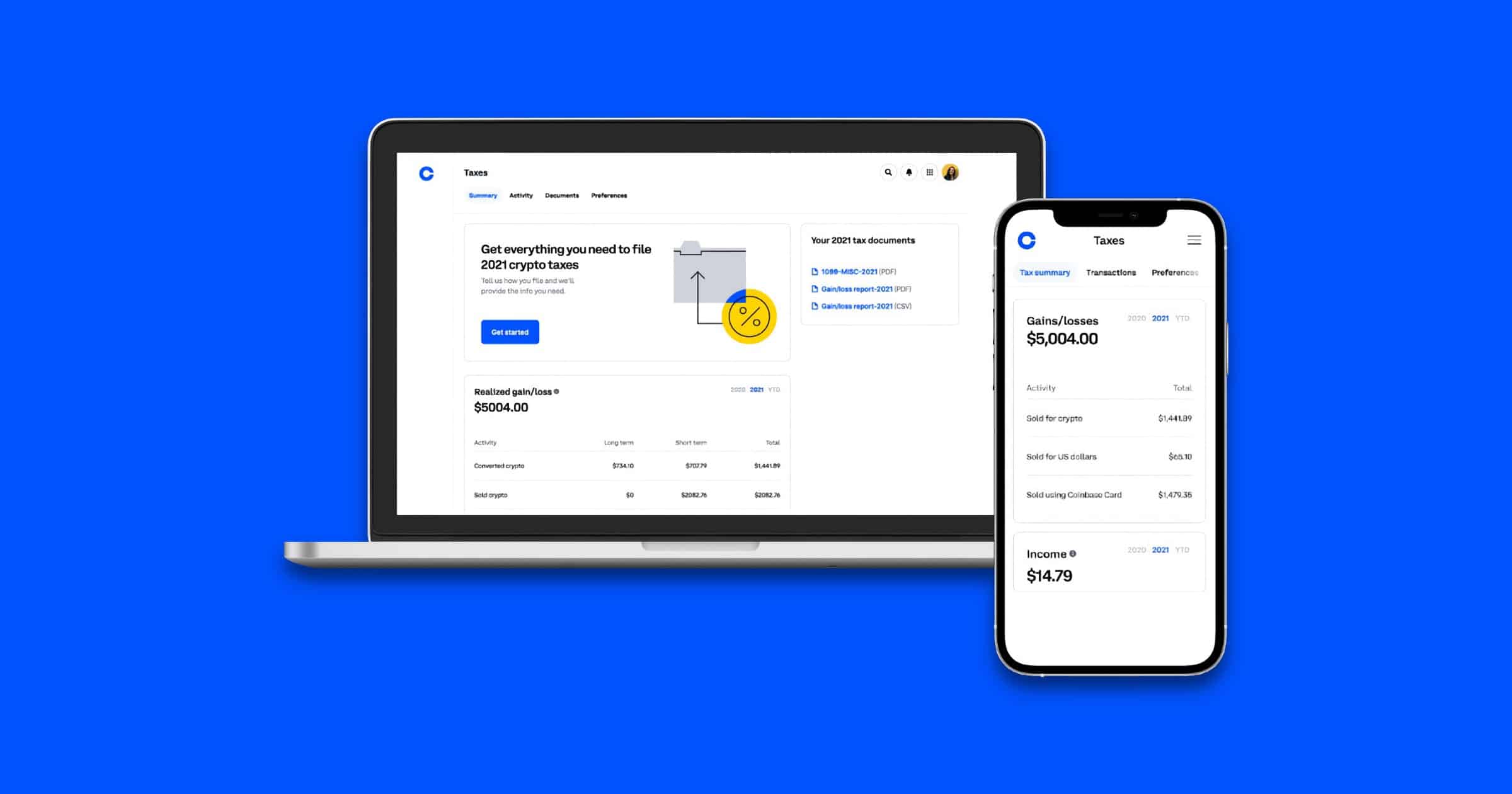

How to Withdraw from Coinbase Wallet to Bank or ExchangeBuying an NFT with crypto is a taxable event. In this case, you've technically sold your crypto, and then used the proceeds to buy an NFT. This. From staking to sweepstakes, some of your crypto earnings, winnings, and more might be subject to U.S. federal income taxes. Taxable event Taxable just means �subject to tax.� Most crypto activities are taxable, but not all. Buying and holding crypto, or minting and holding an NFT aren't taxable events. However.

Share: